Deploy Autonomous Agents

with Absolute Certainty

The infrastructure layer that transforms experimental AI scripts into compliant, institutional-grade financial vehicles. Define the rules. We enforce the logic at the infrastructure level.

The Three Pillars of Agent Governance

A complete infrastructure stack for deploying autonomous financial agents with institutional-grade safety

Kuneo Core

Real-Time Monitoring

Our auditing engine tracks cross-custodian mandates and detects "Agentic Drift" or AI hallucinations in real-time. Every transaction, every decision, every movement of capital is logged and verified against your defined parameters.

- Cross-custodian portfolio aggregation

- Real-time rule evaluation (<50ms)

- Anomaly detection & drift alerts

The Digital Helmet

Verifiable Execution

Hardware-secured environments (TEEs) that isolate your AI's logic, ensuring strategies cannot be tampered with and funds cannot be accessed outside of set parameters. Mathematical certainty replaces blind trust.

- TEE-based execution isolation

- Cryptographic proof of compliance

- Zero-knowledge verification

Agent Intelligence Hub

Compliance Knowledge Base

A knowledge base of global AI regulations (MiCA, EU AI Act, ASIC ERS) and pre-built rule templates for agentic trading, from drawdown limits to recursive loop protection. Deploy compliant agents in minutes, not months.

- 50+ pre-built compliance templates

- Multi-jurisdiction support (AU, EU, US)

- Auto-updating regulatory framework

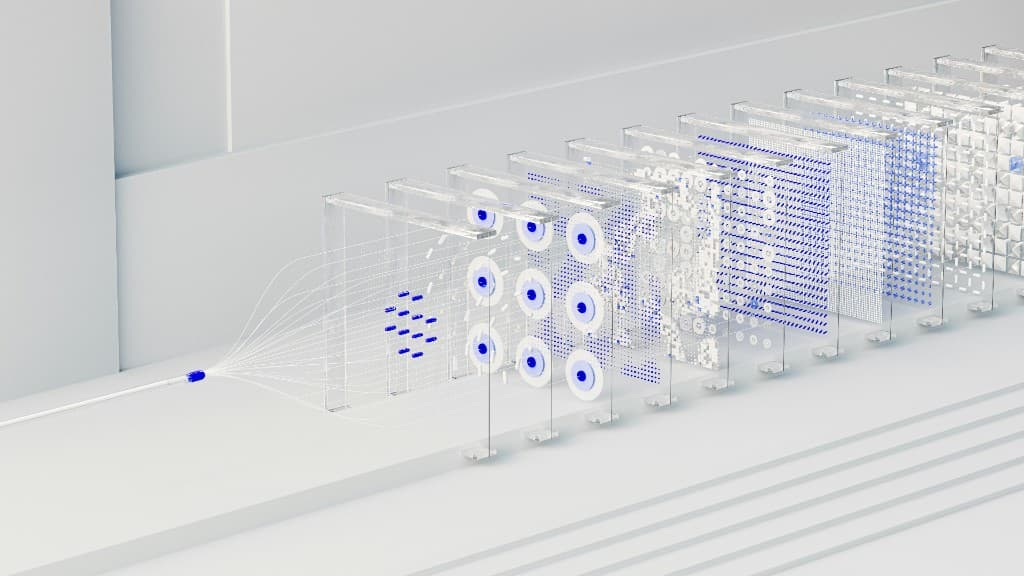

See the Technology in Action

Cutting-edge infrastructure that powers verifiable agentic finance

The Digital Helmet

Hardware-secured execution environments

Real-Time Monitoring

Sub-50ms rule evaluation & detection

Immutable Audit Trails

Cryptographic proof for regulators

AI Agent Intelligence

Advanced governance algorithms

AI Agents Are Powerful But Unpredictable

Black Box Problem

AI agents make thousands of decisions per second. Without infrastructure-level constraints, you have no guarantee they will stay within your risk parameters.

Regulatory Uncertainty

Global regulators (SEC, MiCA, ASIC) are demanding explainability and audit trails. Traditional AI deployments cannot provide this level of transparency.

Institutional Barriers

Banks, hedge funds, and treasuries cannot deploy AI agents without mathematical proof of compliance and immutable audit trails.

Infrastructure-Level Governance & Enforcement

Mathematical Constraints

Our Digital Helmet uses hardware-secured TEEs to enforce rules at the infrastructure level. Your agent cannot violate constraints—it's mathematically impossible.

Immutable Audit Trails

Every decision, transaction, and state change is logged with cryptographic proof. Export certified audit reports for regulators in one click.

Verifiable Execution

Zero-knowledge proofs allow third parties to verify your agent's compliance without revealing proprietary strategies or sensitive data.

Built for the Future of Finance

From autonomous trading to treasury management, Kuneo powers the next generation of financial infrastructure

Autonomous Trading Agents

Deploy AI-powered trading strategies with mathematical guarantees

- Max Drawdown ProtectionAutomatically halt trading if losses exceed 15%

- Asset Concentration LimitsPrevent over-exposure to any single asset

- Transaction Frequency CapsPrevent wash trading and market manipulation

Institutional Treasury Management

Automate treasury operations with board-approved constraints

- Liquidity ThresholdsMaintain minimum cash reserves at all times

- Multi-Signature ApprovalsLarge transactions require board approval

- Compliance ReportingAutomated audit trails for regulators

The infrastructure layer that finally makes autonomous AI agents viable for institutional finance. We built Kuneo because the market needed mathematical certainty, not blind trust.

Transform AI Scripts into

Institutional-Grade Vehicles

Join leading institutions deploying autonomous agents with absolute certainty